August, 2007

Registration received from NHB on 13th August, 2007 to operate as a Housing Finance Company.

Mahindra Home Finance (Mahindra Rural Housing Finance Ltd.) is a subsidiary of Mahindra Finance that provides accessible home loans for those living in rural, semi-urban to urban areas ... Read More

Mahindra Home Finance (Mahindra Rural Housing Finance Ltd.) is a subsidiary of Mahindra Finance that provides accessible home loans for those living in rural, semi-urban to urban areas.

Since 2007, we are a trusted home loan partner for over 1.2 million customers and their dream homes. Present across 16+ states, we provide our services to 88,000+ villages through 730+ physical branches across Maharashtra, Telangana, Andhra Pradesh, Kerala, Karnataka, Madhya Pradesh, Chhattisgarh, Uttar Pradesh, Bihar, Delhi & NCR, Rajasthan, Punjab, Haryana, Gujarat, Odisha, Uttarakhand, Tamil Nadu & Pondicherry.

At Mahindra Home Finance, we are more than just a traditional housing finance company. Our Rise philosophy enables us to challenge the status quo to drive a positive change across several rural communities especially women and marginalized sections by establishing their creditworthiness. Our mission of ‘Transforming Lives’ of those residing in Bharat through improving access to housing makes Mahindra Home Finance one of the largest rural housing finance companies serving both rural and semi-urban areas today.

We understand that a home is the most precious asset for our customers. Our simplified home loan solutions for rural and semi urban housing are further customized to meet our customer’s requirement around their buying, construction, renovation, and home extension needs. This enables us to honor our commitment towards the vision of ‘Home for every Indian.’

To know more Mahindra Home Finance loan services, call us at 1800 233 5333 (Toll Free).

Mahindra Home Finance (Mahindra Rural Housing Finance Ltd.) is a subsidiary of Mahindra Finance that provides accessible home loans for those living in rural, semi-urban to urban areas.

what does 'rise' mean?

Today, as India’s largest rural non-banking financial company, Mahindra Finance has impacted the lives of over 3.6 million customers.

read morePresent in more than 100 countries and employing over 200,000 people across 20 key industries that form the foundation of every modern economy.

read more

Over 70% of customers have had an annual income of less than ₹ 2 lakh

Credit in rural India has been highly unorganized

Local moneylenders have had exorbitant interest rates

Rural customers have had income profiles that are not steady

Ticket size for loan requirements have been extremely small

Customers live far from each other, having made them difficult to reach & serve

Over 65% of the nation's population still lives in rural areas and we decided to serve them

Our parent, Mahindra Finance has developed a strong and trusted brand name through years of financing vehicles and tractors

The Mahindra brand-name was trusted across the country, especially rural markets and we decided to not just leverage it but also live up to it

We decided to always maintain sound financial health and in line with the Mahindra philosophy this also enabled us to build a sound reputation in the eyes of regulators and governments alike

With access to over 1100 locations and millions of customers, we now had to build a product that was not just path-breaking but also one which was easy to understand.

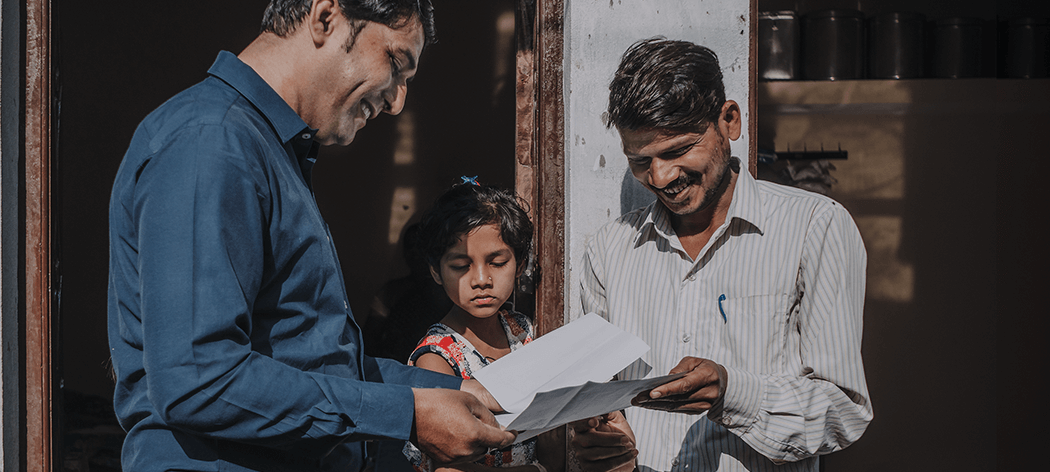

We provide personalized service where agents meet customers at their doorstep, any time of the day

We enable all customers to maintain proper documentation

We hire locally to adapt to local complexities and evaluate every customer's application in detail

We conduct due diligence and credit evaluation based on our understanding of local nuances.

We serve the 'Affordable Housing' customer too

We partner with Central and State governmentsand work with the Pradhan Mantri Awas Yojana (Housing for All by 2022)

We service individuals and segments of society that are underserved by banks and other financial institutions

We aspire to set the highest standard for housing finance in rural India in terms of profitability, growth, employee engagement, trust, and awareness. We aim to increase home ownership and resources in the housing finance sector of rural India. As we have shown, by our initial success in this market as well as our constant growth and profits, we have laid the foundations for our future.

How do we transform lives?

We will challenge conventional thinking and innovatively use all our resources to drive positive change in the lives of our stakeholders and communities across the world, to enable them to Rise.

We will foster local entrepreneurship within the organization which means that our employees will be trusted and hence empowered. At each level/location, our employees will be encouraged to take decisions in the best interest of the company and the business. Each one of us must agree to be held responsible for our decisions and take each and every decision as if we are taking it for our personal business involving our own money and resources.

We will ensure the highest level of integrity which entails:

Financial Integrity: Pertaining to financial/accounting matters.

Intellectual Integrity: We will always voice our concerns about what we feel is right or wrong.

Transactional Integrity: Integrity in dealings with others whether they are a customer, a colleague or any stakeholder.

We will operate as a team. We have a common vision, a common goal. We will ensure that we achieve that goal while working as a team to achieve it in the fastest possible way. However good an individual may be, the collective wisdom and efforts of a team will always be superior to his wisdom of efforts.

We believe in having a high risk taking ability through appropriate risk mitigation. As an organization, we are willing to assist customers who are not being serviced adequately by other players. Our focus will be on the customer, his needs and the best possible way to service him without compromising the organization’s interests.

We will be customer centric as well as fair and transparent in our dealings. We will reach out to identify our customers, understand their requirements, be empathetic in our dealings and design and deliver our products and services keeping them in mind at all times. We will accord them the highest possible respect, in the process earning their respect for our efforts.

Previous

Previous

Next

Next

We will foster local entrepreneurship within the organization which means that our employees will be trusted and hence empowered. At each level/location, our employees will be encouraged to take decisions in the best interest of the company and the business. Each one of us must agree to be held responsible for our decisions and take each and every decision as if we are taking it for our personal business involving our own money and resources.

We will ensure the highest level of integrity which entails:

Financial Integrity: Pertaining to financial/accounting matters.

Intellectual Integrity: We will always voice our concerns about what we feel is right or wrong.

Transactional Integrity: Integrity in dealings with others whether they are a customer, a colleague or any stakeholder.

We will operate as a team. We have a common vision, a common goal. We will ensure that we achieve that goal while working as a team to achieve it in the fastest possible way. However good an individual may be, the collective wisdom and efforts of a team will always be superior to his wisdom of efforts.

We believe in having a high risk taking ability through appropriate risk mitigation. As an organization, we are willing to assist customers who are not being serviced adequately by other players. Our focus will be on the customer, his needs and the best possible way to service him without compromising the organization’s interests.

We will be customer centric as well as fair and transparent in our dealings. We will reach out to identify our customers, understand their requirements, be empathetic in our dealings and design and deliver our products and services keeping them in mind at all times. We will accord them the highest possible respect, in the process earning their respect for our efforts.

Previous

Previous

Next

Next

Registration received from NHB on 13th August, 2007 to operate as a Housing Finance Company.

First loan was disbursed in October 2007.

Commercial operations started across 36 locations of Gujarat and Maharashtra in 2007/08.

On 12th August 2008, the Company executed a Subscription Agreement with NHB and NHB took a 12.5% stake in the company.

Received a credit rating of CARE BBB-(Issuer) from CARE IN F-2008- 09, which indicates moderate safety for timely servicing of debt obligations.

In 2009-10 Company availed sanction of Refinance Assistance from National Housing Bank (NHB) of Rs. 75 cr.

CARE upgraded the Issuer rating to “CARE BBB+(Issuer) in 2009-10,which indicates moderate safety for timely servicing of debt obligations.

CRISIL assigned A+/Stable to the long-term bank facilities on January, 10, 2011.

The number of locations in which loans have been disbursed crossed 150+ in the second half of 2010-11.

MRHFL won the ‘Golden Peacock Innovation Management Award’ in 2012.

MRHFL was selected by Harvard Business School for F.I.E.L.D Project in Aug-2012.

Crossed cumulative number of cases of 100,000 by December-12.

MRHFL was awarded Bronze for ‘Product Excellence’ in the ‘Global CSR Summit & Awards 2013’ held in Davao, Philippines.

MRHFL was awarded the “Gold” in the Housing category at the Skoch Awards for Corporate Leadership 2013.

The Company’s consortium of lenders was formed in FY 13.

In 2013, MRHFL became member of the UNDP’s ‘Business Call-to- Action’, a confirmation of MRHFL’s leadership in, and commitment to, inclusive and sustainable business initiatives at the Bottom of the Pyramid (BoP).

MRHFL was awarded the “Gold” in the Housing category at the Skoch Awards for Corporate Leadership 2013.

MRHFL won the Skoch ‘Order of Merit’ for qualifying amongst ‘India’s best – 2013’ for corporate contribution to India’s growth post liberalization in November 2013.

In FY-13, MRHFL declared a dividend of 10%.

By March 31st, 2013, MRHFL’s staff strength crossed 1000 members.

During the twelve months period ended 31st March 2013, the Profit after Tax (PAT) registered a growth of 71% at Rs. 20.3 Crores as against Rs. 11.9 Crores registered for the same period previous year.

Rights issue of Rs. 50 Crores opened at premium of Rs. 15. NHB has confirmed their willingness to participate.

MRHFL was awarded the ‘Most Admired Service Provider in Financial Sector’ at the Banking, Financial Services & Insurance Awards presented by ABP News on 14th February, 2014.

In FY 15-16, Company won the prestigious Porter Prize Award for ‘Industry Architectural Shift’ which recognized the Company’s outstanding performance in the industry and its contribution in re-defining

the industry structure by challenging the very basis of competition.

In Feb, 2017 MRHFL’s CARE AA+ rating is reaffirmed by CARE which represents stability and asset quality.

Registration received from NHB on 13th August, 2007 to operate as a Housing Finance Company.

First loan was disbursed in October 2007.

Registration received from NHB on 13th August, 2007 to operate as a Housing Finance Company.

First loan was disbursed in October 2007.

Commercial operations started across 36 locations of Gujarat and Maharashtra in 2007/08.

On 12th August 2008, the Company executed a Subscription Agreement with NHB and NHB took a 12.5% stake in the company.

Received a credit rating of CARE BBB-(Issuer) from CARE IN F-2008- 09, which indicates moderate safety for timely servicing of debt obligations.

In 2009-10 Company availed sanction of Refinance Assistance from National Housing Bank (NHB) of Rs. 75 cr.

CARE upgraded the Issuer rating to “CARE BBB+(Issuer) in 2009-10,which indicates moderate safety for timely servicing of debt obligations.

CRISIL assigned A+/Stable to the long-term bank facilities on January, 10, 2011.

The number of locations in which loans have been disbursed crossed 150+ in the second half of 2010-11.

MRHFL won the ‘Golden Peacock Innovation Management Award’ in 2012.

MRHFL was selected by Harvard Business School for F.I.E.L.D Project in Aug-2012.

Crossed cumulative number of cases of 100,000 by December-12.

MRHFL was awarded Bronze for ‘Product Excellence’ in the ‘Global CSR Summit & Awards 2013’ held in Davao, Philippines.

MRHFL was awarded the “Gold” in the Housing category at the Skoch Awards for Corporate Leadership 2013.

The Company’s consortium of lenders was formed in FY 13.

In 2013, MRHFL became member of the UNDP’s ‘Business Call-to- Action’, a confirmation of MRHFL’s leadership in, and commitment to, inclusive and sustainable business initiatives at the Bottom of the Pyramid (BoP).

MRHFL was awarded the “Gold” in the Housing category at the Skoch Awards for Corporate Leadership 2013.

MRHFL won the Skoch ‘Order of Merit’ for qualifying amongst ‘India’s best – 2013’ for corporate contribution to India’s growth post liberalization in November 2013.

In FY-13, MRHFL declared a dividend of 10%.

By March 31st, 2013, MRHFL’s staff strength crossed 1000 members.

During the twelve months period ended 31st March 2013, the Profit after Tax (PAT) registered a growth of 71% at Rs. 20.3 Crores as against Rs. 11.9 Crores registered for the same period previous year.

Rights issue of Rs. 50 Crores opened at premium of Rs. 15. NHB has confirmed their willingness to participate.

MRHFL was awarded the ‘Most Admired Service Provider in Financial Sector’ at the Banking, Financial Services & Insurance Awards presented by ABP News on 14th February, 2014.

In FY 15-16, Company won the prestigious Porter Prize Award for ‘Industry Architectural Shift’ which recognized the Company’s outstanding performance in the industry and its contribution in re-defining

the industry structure by challenging the very basis of competition.

In Feb, 2017 MRHFL’s CARE AA+ rating is reaffirmed by CARE which represents stability and asset quality.

Previous

Previous

Next

Next

Shantanu Rege

Managing Director & CEO

Dinesh Prajapati

Chief Financial Officer

Aniruddha Shende

National Business Head – Affordable Housing

Pankaj Verma

National Head – Credit

Sourabha Kolhapure

Chief Technology Officer

Hitesh Agrawal

Chief Risk Officer

Jinesh Jain

Chief Strategy Officer

Abhimanyu Sen

Head HR and I&S

Chetan Bhave

Head Legal

Bharti Jain

Chief Compliance Officer

Prafulla Athalye

Head-Technical & Builder Relations

Employees

18000

Branches

1100

Customers

30 lakh

Over 2 decades ago Mahindra and Mahindra Financial Services Limited (MMFSL) commenced its journey in the rural non-banking finance industry. Providing individuals with personalized finance for a wide range of vehicles, small-scale business requirements, and many other diverse endeavours – all to help people live their dreams and Rise in life.

Mahindra Finance noticed the rural market in India was extremely underserved, especially when compared to a highly competitive, reasonably well-developed urban market. This wide gap provided an opportunity. In 2007, as an Industry leader with a healthy financial condition and a good reputation with the Reserve Bank of India, Mahindra Finance (MMFSL), setup Mahindra Rural Housing Finance Limited (MRHFL) to offer home loans – for new home purchase, construction, and home improvement in rural parts of India.

Mahindra & Mahindra Financial Services Limited (MMFSL) currently holds an 89% stake in Mahindra Rural Housing Finance Limited (MRHFL).

KEY INDUSTRIES

20

COUNTRIES

100+

EMPLOYEES

2 Lakh

The Mahindra Group operates in over 20 key industries, providing insightful and ingenious solutions that are global in their ramifications. All the companies act as a federation, with an optimum balance of entrepreneurial independence and synergy. From Mobility to Rural Prosperity and IT, from Financial Services to Clean Energy and Business Productivity, The Mahindra Group is empowering enterprise everywhere. Headquartered in Mumbai, India, they have an operational presence in over 100 countries and employ more than 200,000 people. And although they operate across vast geographies, thier governing spirit of “Rise” binds all the companies as one Mahindra, dictating that we empower people everywhere to not only chart new frontiers, but to conquer them too.

The world’s largest tractor brand by volume, and India’s largest utility vehicle manufacturer. The Mahindra Group remains committed to investing in technology, growing India’s global presence while maintaining leadership positions. They are the largest NBFC in rural and semi-urban India. They are one of the top 5 IT service providers in India. They are India’s leading vacation ownership company. And are India’s largest multi-brand, pre-owned car company. This is The Mahindra Group.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.